question archive Q1 Suppose you bought an XYZ Put Option with a strike price of $33 expiring in 30 days

Q1 Suppose you bought an XYZ Put Option with a strike price of $33 expiring in 30 days

Subject:BusinessPrice: Bought3

Q1

Suppose you bought an XYZ Put Option with a strike price of $33 expiring in 30 days. This option is currently trading at $7.50. The Stock is currently at $28.

How much intrinsic value does this option have? How much time value?

Q2

A portfolio manager has a bond portfolio of $20 million. The duration of the portfolio is 6.7 years.

The front month T-bond futures price is currently at: 107-15. The cheapest-to-deliver bond has a duration of 7 years. How many contracts (long or short) should the manager trade to hedge the portfolio risk against changes in interest rates?

Q3

How is a forward rate agreement (FRA) different from a SWAP?

Name some distinct differences as well as pros and cons of the two.

Q4

In what situations would an investor want to create a synthetic short position in a stock rather than buying the stock outright? Give a detailed explanation with an example and discuss the pros and cons of creating a synthetic short position.

Q5

Suppose you short a $42 Put with a premium of $3 and bought a $38 Put with a premium of $1. What is this strategy called? Ignoring time value of money and transaction costs, calculate max. profit, max. loss and break-even price.

Q6

An investor is considering the following option strategy:

Short 1 ABC 42 Call with a premium of $3.50 and Short 1 ABC 38 Put with a premium of $2.50

a) Name the strategy and draw a diagram showing the pay-off at maturity

b) For what range of stock prices would this strategy lead to a profit/loss? Calculate max. profit/loss

c) Under what assumptions would an investor employ this strategy. Will it help managing risk?

Bonus Question

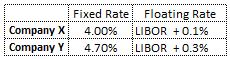

Companies X and Y have been offered the following rates per annum on a $50 million 5-year loan:

Company X requires a floating-rate loan; company Y requires a fixed-rate loan. Design a swap that will net a bank, acting as intermediary, 0.100% per annum and will be equally attractive to X and Y.

Draw a graph similar to our examples in week 3 to show your answer.